Singapore company formation sets a firm deadline in motion. Six months from incorporation, every business must have a qualified company secretary in place—this is statutory law with no flexibility. The real strategic question isn’t about meeting this requirement, but how you structure its fulfillment. Will this compliance professional sit at a desk in your office, or will you retain a firm that specializes in delivering corporate secretarial services to multiple organizations?

Entrepreneurs and financial officers often default to quick cost estimates when weighing this choice. This approach misses the mark because the true cost picture runs deeper than salary comparisons suggest, and the risk factors rarely get the analytical attention they deserve. Here is the thorough examination your decision requires.

What Corporate Secretarial Services Actually Involve

Before crunching numbers, clarity on the role is essential. A company secretary in Singapore is mandatory under the Companies Act. The job carries real weight: keeping statutory registers accurate and current, filing annual returns with ACRA, drafting and submitting board resolutions, guiding directors on compliance matters, and making sure any changes to company structure—directors, shareholders, share capital—are properly documented and filed.

This is not a simple admin job. It demands up-to-date knowledge of the Companies Act, ACRA’s filing requirements, and increasingly, familiarity with beneficial ownership rules under the Register of Registrable Controllers. Mistakes have teeth. Late or wrong filings bring fines, and repeated problems can put your company on regulators’ radar.

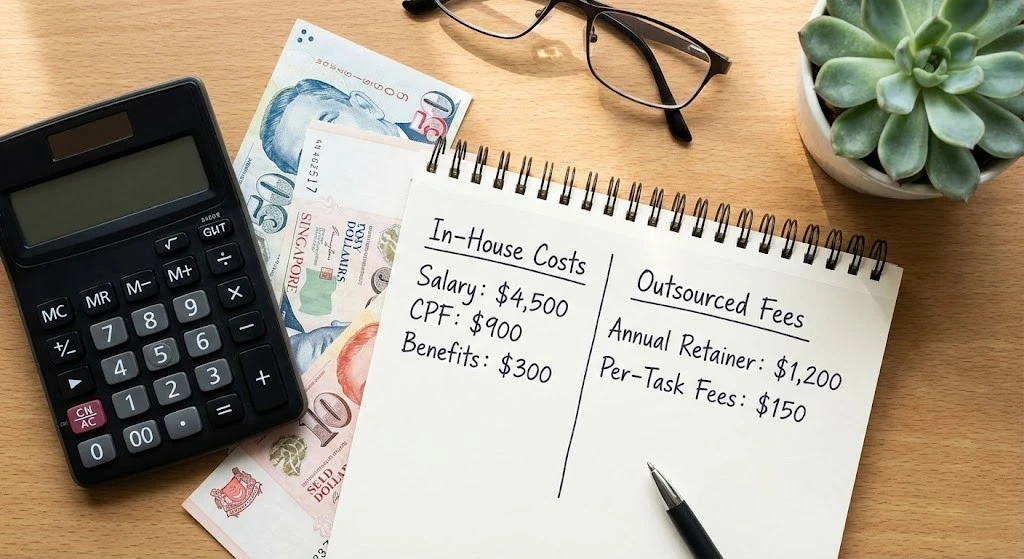

The Real Price Tag of a Company Secretary on Staff

The number that first catches the eye is salary. A qualified company secretary in Singapore typically earns SGD 48,000 to SGD 84,000 per year, depending on experience and how complex your company is. Most fall in the SGD 60,000 to SGD 70,000 range if they have ICSA or SAICSA qualifications and a few years under their belt.

But salary is just the starting point.

Add employer CPF at 17%: that’s another SGD 10,000 to SGD 14,000 annually. Then factor in annual leave, medical benefits, and the very real cost of hiring again when they leave—which happens often in Singapore’s tight job market. Add training to keep their knowledge current, office space and equipment, and the management time spent overseeing this technical role.

When you add it all up, a company secretary on your payroll costs most SMEs and mid-sized firms between SGD 85,000 and SGD 110,000 per year in total. Larger companies with complex structures or multiple entities may need more than one person.

There is also the utilization problem. For most firms, secretarial work comes in waves. Annual returns, AGM prep, and routine resolutions pile up at certain times of year. Between these busy periods, the role has significant downtime. You are paying a full salary for work that, for many companies, does not amount to full-time hours.

What External Corporate Secretarial Services Cost

Outsourced corporate secretarial services in Singapore usually work on a retainer basis. For a standard private limited company with simple needs, annual fees run from SGD 600 to SGD 2,500 at the low end, up to SGD 4,000 to SGD 8,000 for companies with more complex situations, multiple share classes, frequent resolutions, or cross-border issues.

Extra services—like preparing special resolutions, handling share transfers, or supporting fundraising due diligence—are typically billed separately by the task.

Even at the high end for a complex SME, you are looking at SGD 8,000 to SGD 15,000 per year total. Compared to the SGD 85,000 to SGD 110,000 cost of hiring in-house, the savings are not small—they are fundamental.

What you trade off is speed and exclusive attention. An external provider has many clients. During busy compliance periods—ACRA filing seasons, AGM windows—response times can slow. If you need a resolution turned around the same day, you are at the mercy of their queue.

The Risk Factor Most Analyses Miss

Cost comparisons ignore what actually keeps directors awake: compliance risk.

An in-house company secretary who goes on long leave, quits suddenly, or simply falls behind on regulatory changes creates real exposure. Updates to the Companies Act, changes to ACRA’s digital systems, and new beneficial ownership reporting rules require ongoing learning. If your in-house hire is not keeping up, you may not know until a filing bounces back or a penalty notice arrives.

Good corporate secretarial services firms work in teams, not solo. Your account is handled by people whose whole job depends on knowing the current rules. When ACRA changes something, they adjust their processes right away. There is no single point of failure.

For companies with foreign directors or shareholders, complex group structures, or any past regulatory issues, this risk angle often tips the decision toward outsourcing. The cost of one serious compliance failure—penalties, legal fees, management distraction—can easily top a year or more of external fees.

When Keeping a Company Secretary In-House Makes Sense

The analysis does not always favor outsourcing. Some company profiles genuinely work better with an internal hire.

Large companies with high transaction volumes and complex, ever-changing structures generate enough work to justify the headcount. If your board meets monthly, you are constantly adding or removing directors, managing share transfers, running multiple subsidiaries, and preparing resolutions regularly, the sheer volume may need full-time attention.

Publicly listed companies have another consideration: proximity. A company secretary who is embedded in board operations, attends every meeting, and gives real-time advice provides value that even the best corporate secretarial services cannot fully match.

Companies in active acquisition or restructuring mode may also find that the volume and urgency of secretarial work makes in-house the practical choice for that period, even if they switch to outsourced once things settle down.

The Middle Path

Some companies find a hybrid solution: outsource the statutory compliance work to a professional firm, but have an existing operations or finance person handle internal coordination. That person manages the relationship with the external provider, tracks deadlines, and handles internal documents, while the qualified secretarial work stays with the specialists.

This works for companies that want responsiveness and internal accountability without the full cost of an in-house hire. It requires the external firm to be genuinely good at communication, and the internal coordinator to understand enough about the process to manage it well.

The Decision Framework

Strip away the complexity and three variables drive this choice: how much secretarial work you have, your appetite for risk, and your company size.

For most startups, SMEs, and companies with simple structures, corporate secretarial services deliver compliance quality equal to or better than an in-house hire at a fraction of the cost. The savings are big enough to fund other priorities, and the risk of using qualified professionals with team backup is actually lower than relying on one employee.

For larger organizations, listed companies, or businesses in active deal mode, the case for in-house strengthens. The volume justifies the cost, and proximity to the board adds real value.

The mistake is deciding based on salary alone, without counting total employment cost, utilization reality, and what a compliance failure actually costs. When you price all three, the choice usually becomes clearer than you expected.

Comments

No comments yet. Be the first to react!